End-to-End Business Verification

Customize your KYB verification process to suit your business's compliance needs. Let Youverify handle critical screening processes including AML, Company Address verification and Ultimate beneficial owner.

1 sec

Average verification time

30min

Quick integration with YV SDK

99%

Completion rate

Satisfy Global Compliance

Youverify compliance solution helps you satisfy global KYB regulatory requirements to avoid penalties.

Rapid Customer Onboarding

Cut down on KYC and KYB client onboarding time without floundering compliance laws. Our end-to-end KYB process is completed in less than 5 hours.

Save Costs

Save costs associated with performing multiple verifications with different vendors by performing them on Youverify. Our elaborate KYB solution combines automated checks from all global compliance requirements for businesses.

Scale your Business with our Comprehensive KYB Solution

Customisable Data Collection Workflow

Simplify customer data collection with customisable forms where users can fill out questionnaires, upload documents and supply information on beneficiaries.

Verify Ultimate Beneficial Owners (UBOs)

Verify a company's ultimate beneficial owners through automated KYC checks to satisfy compliance requirements and prevent fraud.

AML & PEP Screening

Screen company board of directors, UBOs and employees for AML and PEP sanction lists. Get real-time updates from adverse media screening on the go.

Verify Business Data

Verify and monitor business data through global registries from government-backed sources.

Start Performing Seamless KYB Today

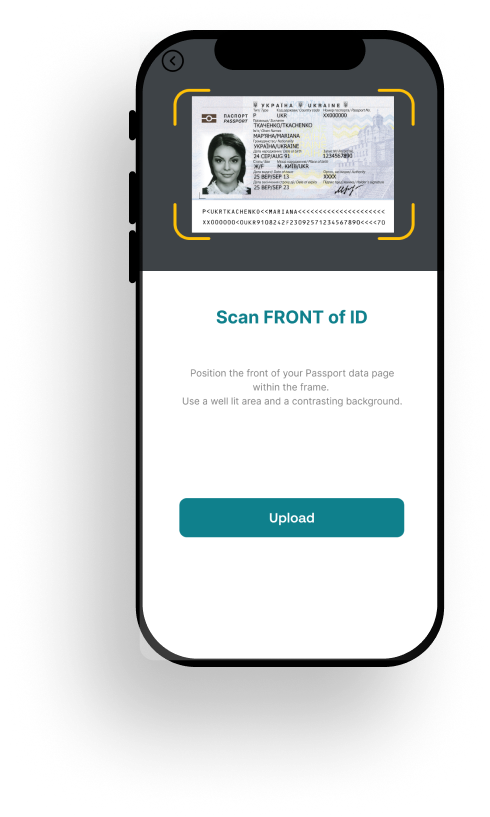

Book a Free DemoHow the Youverify ID Document Verification Works

Step 1

You onboard our platform, set up your account and customize the user onboarding flow to suit your business needs.

Step 2

Share a link with your customer, who proceeds to supply the requested company and beneficiary data.

Step 3

Youverify performs business legal verification, document verification, ownership and control verification, ultimate beneficial ownership verification, AML screening, PEP screening and KYC verification on beneficiaries.

Step 4

Youverify's in-house experts review the result for quality control and assurance.

Step 5

You receive the result on your case management dashboard at the end of the KYB process.

Automate Your KYB Processes Today With Youverify

Begin your journey with Youverify. Send us a message right away!

Frequently Asked Questions

What is Know Your Business (KYB)?

Know Your Business is an AML verification procedure carried out to confirm the legal status of a business and its compliance with Anti Money Laundering (AML) and other industry regulations.

.8e0460f.jpeg)

.c81751b.png)

.33cf39d.png)

.svg (1).b34adf7.png)

.a6fa68b.png)

.4f1915b.png)